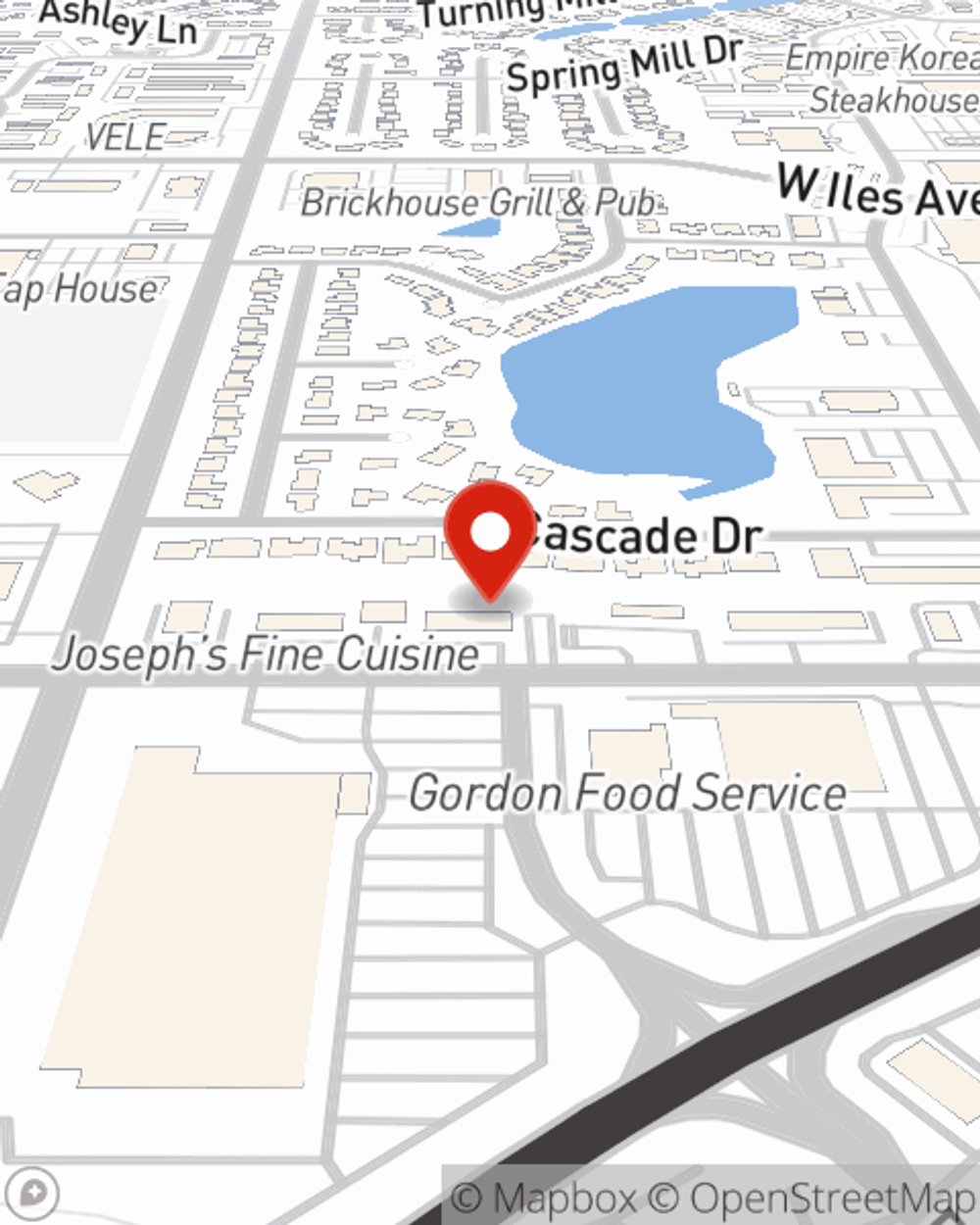

Business Insurance in and around Springfield

One of the top small business insurance companies in Springfield, and beyond.

No funny business here

Your Search For Reliable Small Business Insurance Ends Now.

Preparation is key for when a catastrophe happens on your business's property like a customer hurting themselves.

One of the top small business insurance companies in Springfield, and beyond.

No funny business here

Customizable Coverage For Your Business

The unexpected is, well, unexpected, but it's better to expect it so that you're prepared. State Farm has a wide range of coverages, like a surety or fidelity bond or business continuity plans, that can be formed to develop a customized policy to fit your small business's needs. And when the unexpected does occur, agent Trae Covington can also help you file your claim.

So, take the responsible next step for your business and contact State Farm agent Trae Covington to discover your small business insurance options!

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

Trae Covington

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.